How to Create a PayPal Account to Accept Online Payments

3K views · May 1, 2024 physicscalculations.com

Discover how to effortlessly set up your PayPal account to start accepting online payments with ease! Whether you're launching an e-commerce store, freelancing, or selling goods and services online, this step-by-step guide will walk you through the entire process. From creating your PayPal account to verifying and linking it to your bank account or credit card, you'll learn the essential tips and tricks to maximize PayPal's features for seamless payment transactions. Don't miss out on this essential tutorial that could transform your online business!

Remote jobs from home at wokminer

304 views · May 1, 2024 physicscalculations.com

Best job search engine at wokminer.com Search for any job of your preference at any location and apply today.

How to apply for paypal jobs - ($75,000 to $150,000) #paypal...

6 views · May 1, 2024 physicscalculations.com

How to apply for paypal jobs - ($75,000 to $150,000) #paypal #jobs #jobsearch #paypaljobs #job

How to apply for paypal jobs - ($75,000 to $150,000) #paypal...

6 views · May 1, 2024 physicscalculations.com

How to apply for paypal jobs - ($75,000 to $150,000) #paypal #jobs #jobsearch #paypaljobs #job

How Do Solar Energy Companies Make Money?

8K views · Aug 5, 2023 physicscalculations.com

In this video, we uncover the strategies and business models behind how solar energy companies make money. We'll explore various revenue streams such as solar panel installation services, financing options like solar leases and power purchase agreements (PPAs), and the role of renewable energy credits (RECs) and net metering in profitability. Through case studies and expert insights, you'll gain a deeper understanding of the economic dynamics within the solar industry, including the factors influencing profitability and sustainability. Whether you're considering investing in solar energy or interested in the business side of renewable energy, this video will provide valuable information on how solar energy companies generate revenue. #SolarEnergyCompanies #SolarPower #RenewableEnergy #SolarBusiness #SolarInstallation #SolarFinance #EnergyInvestment #NetMetering #SolarROI #GreenEnergy

How Do Solar Energy Companies Make Money?

8K views · Aug 5, 2023 physicscalculations.com

In this video, we uncover the strategies and business models behind how solar energy companies make money. We'll explore various revenue streams such as solar panel installation services, financing options like solar leases and power purchase agreements (PPAs), and the role of renewable energy credits (RECs) and net metering in profitability. Through case studies and expert insights, you'll gain a deeper understanding of the economic dynamics within the solar industry, including the factors influencing profitability and sustainability. Whether you're considering investing in solar energy or interested in the business side of renewable energy, this video will provide valuable information on how solar energy companies generate revenue. #SolarEnergyCompanies #SolarPower #RenewableEnergy #SolarBusiness #SolarInstallation #SolarFinance #EnergyInvestment #NetMetering #SolarROI #GreenEnergy

How Do Solar Energy Companies Make Money?

8K views · Aug 5, 2023 physicscalculations.com

In this video, we uncover the strategies and business models behind how solar energy companies make money. We'll explore various revenue streams such as solar panel installation services, financing options like solar leases and power purchase agreements (PPAs), and the role of renewable energy credits (RECs) and net metering in profitability. Through case studies and expert insights, you'll gain a deeper understanding of the economic dynamics within the solar industry, including the factors influencing profitability and sustainability. Whether you're considering investing in solar energy or interested in the business side of renewable energy, this video will provide valuable information on how solar energy companies generate revenue. #SolarEnergyCompanies #SolarPower #RenewableEnergy #SolarBusiness #SolarInstallation #SolarFinance #EnergyInvestment #NetMetering #SolarROI #GreenEnergy

10 LAZY WAYS TO MAKE LEGITIMATE MONEY

3K views · Jun 21, 2024 physicscalculations.com

In this video, we reveal 10 lazy ways to make legitimate money with minimal effort. From passive income streams to easy side hustles, these strategies are perfect for those looking to boost their earnings without investing a lot of time or energy. Discover simple and effective methods to generate extra cash, whether you're looking for online opportunities, investment tips, or low-effort jobs. Whether you're a busy professional or just want to make some quick cash on the side, these lazy money-making ideas are designed to help you achieve financial freedom effortlessly. #LazyMoneyMaking #PassiveIncome #EasyEarnings #SideHustles #FinancialFreedom #QuickCash #EffortlessIncome #MoneyMakingIdeas #OnlineIncome #IncomeStreams

What is Passive Income? A Beginner's Guide to Earning Mo...

400 views · Jun 29, 2024 physicscalculations.com

Welcome to our channel! In this video, we break down the concept of passive income and how you can start generating money with minimal ongoing effort. Learn about different passive income streams, the benefits, and how to get started today! What You'll Learn: What is passive income? Passive income streams Benefits of earning passive income Tips for building your own passive income sources

10 LAZY WAYS TO MAKE LEGITIMATE MONEY

6 views · Aug 4, 2024 physicscalculations.com

In this video, we reveal 10 lazy ways to make legitimate money with minimal effort. From passive income streams to easy side hustles, these strategies are perfect for those looking to boost their earnings without investing a lot of time or energy. Discover simple and effective methods to generate extra cash, whether you're looking for online opportunities, investment tips, or low-effort jobs. Whether you're a busy professional or just want to make some quick cash on the side, these lazy money-making ideas are designed to help you achieve financial freedom effortlessly. #LazyMoneyMaking #PassiveIncome #EasyEarnings #SideHustles #FinancialFreedom #QuickCash #EffortlessIncome #MoneyMakingIdeas #OnlineIncome #IncomeStreams

What is Passive Income? A Beginner's Guide to Earning Mo...

20 views · Aug 4, 2024 physicscalculations.com

Welcome to our channel! In this video, we break down the concept of passive income and how you can start generating money with little effort. Learn about different passive income streams, the benefits, and how to get started today! What You'll Learn: What is passive income? Passive income streams Benefits of earning passive income Tips for building your own passive income sources If you found this video helpful, don't forget to give it a thumbs up, subscribe to our channel, and hit the bell icon to stay updated with our latest content! #passiveincome #FinancialFreedom #MakeMoneyOnline #Investing #SideHustle #IncomeStreams #WealthBuilding #MoneyTips #OnlineBusiness #EarningMoney #FinanceTips

What is Passive Income? A Beginner's Guide to Earning Mo...

20 views · Aug 4, 2024 physicscalculations.com

Welcome to our channel! In this video, we break down the concept of passive income and how you can start generating money with little effort. Learn about different passive income streams, the benefits, and how to get started today! What You'll Learn: What is passive income? Passive income streams Benefits of earning passive income Tips for building your own passive income sources If you found this video helpful, don't forget to give it a thumbs up, subscribe to our channel, and hit the bell icon to stay updated with our latest content! #passiveincome #FinancialFreedom #MakeMoneyOnline #Investing #SideHustle #IncomeStreams #WealthBuilding #MoneyTips #OnlineBusiness #EarningMoney #FinanceTips

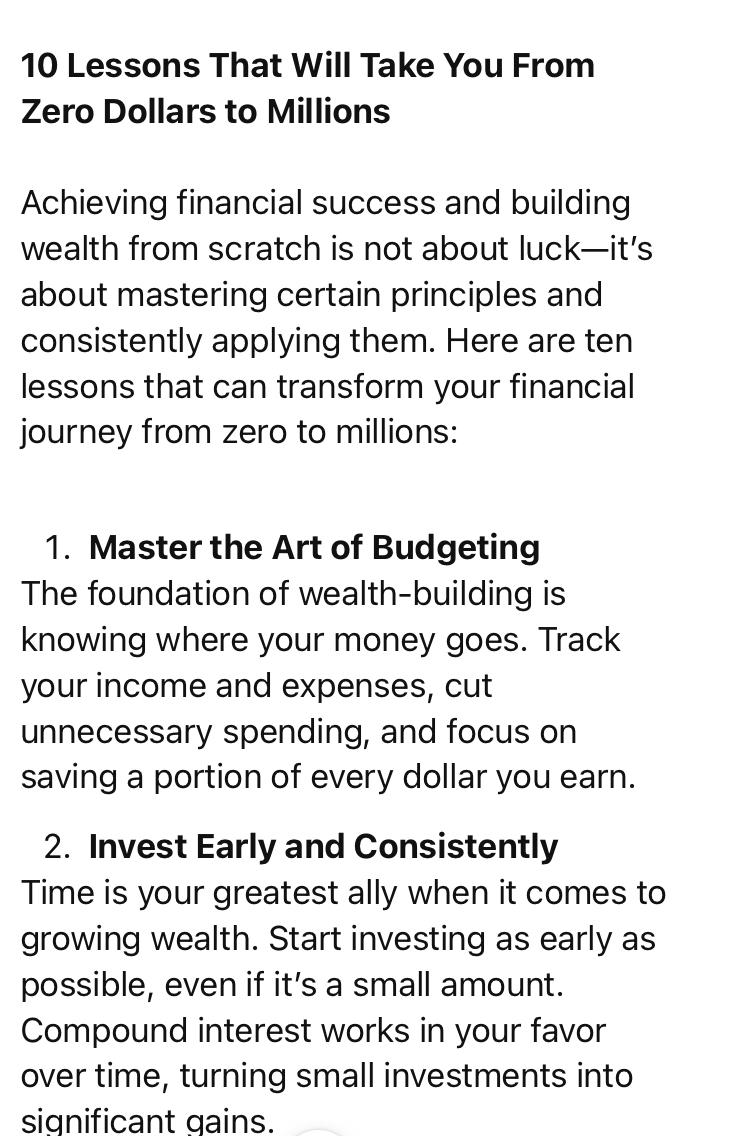

10 Lessons That Will Take You From Zero Dollars to Millions

24 views · Oct 19, 2024 physicscalculations.com

10 Lessons That Will Take You From Zero Dollars to Millions Achieving financial success and building wealth from scratch is not about luck—it’s about mastering certain principles and consistently applying them. Here are ten lessons that can transform your financial journey from zero to millions: 1. Master the Art of Budgeting The foundation of wealth-building is knowing where your money goes. Track your income and expenses, cut unnecessary spending, and focus on saving a portion of every dollar you earn. 2. Invest Early and Consistently Time is your greatest ally when it comes to growing wealth. Start investing as early as possible, even if it’s a small amount. Compound interest works in your favor over time, turning small investments into significant gains. 3. Diversify Your Income Streams Relying on one source of income, like a paycheck, limits your potential. Build multiple streams of income—investments, side businesses, and passive income sources—to create more opportunities for wealth. 4. Embrace the Power of Passive Income Money that works for you, without requiring constant effort, is the key to financial freedom. Real estate, dividend-paying stocks, and online businesses are great ways to generate passive income. 5. Focus on Skills Over Degrees While formal education is valuable, the skills you develop can be far more lucrative. Learn skills that are in high demand, like coding, sales, or digital marketing, and monetize them. 6. Network and Build Relationships Wealth often grows through relationships. Surround yourself with successful people, learn from them, and seize the opportunities that come from being part of the right network. 7. Take Calculated Risks Every millionaire takes risks, but they are calculated, informed decisions. Invest in areas where you have knowledge, and don’t be afraid to step outside of your comfort zone when opportunities arise. 8. Learn to Manage Debt Not all debt is bad. Using debt wisely—such as leveraging it for real estate investments—can multiply your returns. However, avoid high-interest debt like credit cards that can derail your financial goals. 9. Be Patient, But Persistent Building wealth doesn’t happen overnight. Stay patient and consistent with your saving, investing, and business-building efforts. Persistence is what separates those who succeed from those who give up too soon. 10. Give Back and Stay Grounded Many self-made millionaires emphasize the importance of giving back. Whether it’s through charitable donations or mentoring others, staying grounded and helping others keeps you focused on your purpose and success. By internalizing and applying these lessons, you can create a solid foundation that will take you from zero to financial freedom. It’s not just about money—it’s about mastering the mindset and habits that will keep your wealth growing for the long haul.

Passive Income Can Generate Wealth For You In Retirement”

59 views · Oct 21, 2024 physicscalculations.com

Passive Income Can Generate Wealth For You In Retirement

Role of Passive Income

0 views · Oct 21, 2024 physicscalculations.com

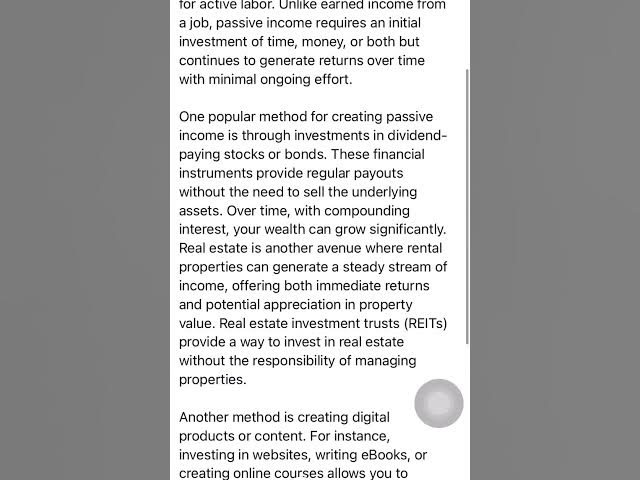

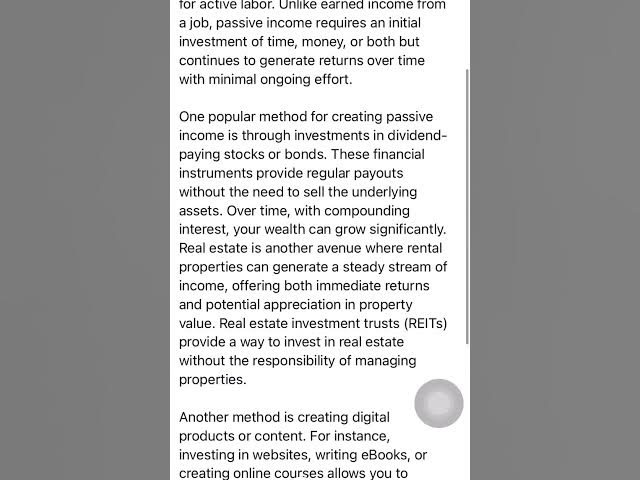

Passive income can play a pivotal role in generating wealth for retirement, offering a reliable financial cushion without the need for active labor. Unlike earned income from a job, passive income requires an initial investment of time, money, or both but continues to generate returns over time with minimal ongoing effort. One popular method for creating passive income is through investments in dividend-paying stocks or bonds. These financial instruments provide regular payouts without the need to sell the underlying assets. Over time, with compounding interest, your wealth can grow significantly. Real estate is another avenue where rental properties can generate a steady stream of income, offering both immediate returns and potential appreciation in property value. Real estate investment trusts (REITs) provide a way to invest in real estate without the responsibility of managing properties. Another method is creating digital products or content. For instance, investing in websites, writing eBooks, or creating online courses allows you to receive income long after the initial creation phase. Affiliate marketing is also a powerful tool in the digital space, enabling you to earn commissions from promoting products or services. During retirement, passive income helps maintain financial stability, reducing the risk of outliving your savings. This diversified income stream offers more flexibility, allowing you to enjoy your retirement while minimizing reliance on traditional pension systems or social security. Furthermore, with the right mix of investments, passive income can keep up with inflation, preserving your purchasing power. By strategically building passive income streams before retirement, you create a financial foundation that offers independence and the freedom to enjoy retirement without constant financial worries.

Looking Ahead: What to Expect for Social Security Beneficiar...

2 views · Oct 21, 2024 physicscalculations.com

The 2024 Cost-of-Living Adjustment (COLA) for Social Security beneficiaries is expected to bring some changes aimed at addressing inflation and helping retirees maintain their purchasing power. COLA adjustments are based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which measures inflation. With inflation fluctuating in recent years, beneficiaries can expect a moderate increase in their Social Security benefits in 2024, though it may not be as significant as the adjustments seen during higher inflation periods. The 2024 COLA is projected to be around 3.2%, which is lower than the 2023 COLA of 8.7%. This is because inflation has been moderating, especially compared to the sharp spikes seen in 2022. For Social Security beneficiaries, this adjustment will mean an increase in monthly benefits, helping them cover rising costs in areas such as healthcare, housing, and other essential expenses. While the COLA increase provides some financial relief, it may not fully offset inflation in all categories, particularly for medical expenses, which tend to rise at a higher rate than the general inflation rate. Beneficiaries should keep in mind that while their Social Security benefits will increase, this also might push some into higher tax brackets or affect income thresholds for Medicare premiums. Looking ahead, Social Security beneficiaries can expect the COLA to continue playing a vital role in protecting their income from inflationary pressures, but it’s also essential to have other retirement income sources to ensure long-term financial security. As the 2024 COLA kicks in, retirees should review their financial plans to ensure that they can adapt to ongoing economic changes.

Social Security and Your Expenses

37 views · Oct 21, 2024 physicscalculations.com

Social Security plays a crucial role in covering expenses during retirement, but it’s important to understand its limitations. While it provides a steady income stream, Social Security benefits were never intended to cover all your living expenses. Instead, they serve as a financial supplement designed to assist with basic needs, such as housing, healthcare, and everyday living costs. For most retirees, Social Security replaces about 40% of pre-retirement income, though this percentage can vary based on earnings history and the age at which you begin collecting benefits. For lower-income earners, Social Security might replace a higher percentage of their income, but it will still likely fall short of covering all expenses. Higher-income earners will see a lower replacement rate, which means they will need to rely more on personal savings, pensions, or other investments to meet their financial needs. Housing and healthcare are two of the largest expenses retirees face, and while Social Security benefits can help cover some of these costs, they may not be enough. Medicare helps with healthcare expenses, but it doesn’t cover everything, leaving beneficiaries responsible for premiums, deductibles, and out-of-pocket costs for things like dental, vision, and long-term care. As healthcare costs tend to rise faster than inflation, retirees relying solely on Social Security may struggle to keep up. Other day-to-day expenses like food, utilities, transportation, and leisure activities can also stretch Social Security benefits thin. Therefore, it’s essential to plan ahead by building additional sources of retirement income through savings, investments, or part-time work. By doing so, you can ensure that Social Security is part of a broader, more robust retirement plan capable of covering your expenses comfortably.

The Truth About Your Lifespan: How to Predict Exactly How Lo...

1 views · Oct 21, 2024 physicscalculations.com

Predicting exactly how long you’ll live is impossible, but several factors can offer insights into your potential lifespan. Genetics, lifestyle choices, and environmental conditions all play key roles in determining life expectancy. While you can’t change your genetic makeup, understanding how these factors interact can help you make better decisions to potentially increase your longevity. Genetics are a significant predictor of lifespan. If your parents and grandparents lived into their 80s or 90s, there’s a higher likelihood that you may too. However, genetics are just part of the equation. Lifestyle choices, including diet, exercise, and stress management, have an equally, if not more, significant impact. Regular physical activity, a diet rich in fruits and vegetables, and managing stress through practices like meditation can contribute to a longer, healthier life. Conversely, habits like smoking, excessive alcohol consumption, and poor diet can drastically shorten your lifespan. Medical advances and preventive healthcare are also important. Regular check-ups and early detection of diseases like cancer or cardiovascular issues can add years to your life. Vaccinations and treatments for chronic illnesses can help manage conditions that might otherwise shorten lifespan. Other factors include social connections and mental health. Research shows that people with strong social networks tend to live longer, as do those who maintain a sense of purpose and mental well-being throughout life. Loneliness, on the other hand, is linked to shorter lifespans. While no tool can predict exactly how long you’ll live, online life expectancy calculators can provide rough estimates based on lifestyle and health metrics. Ultimately, while you can’t control everything, making healthy choices and staying engaged with life can significantly influence how long and how well you live.

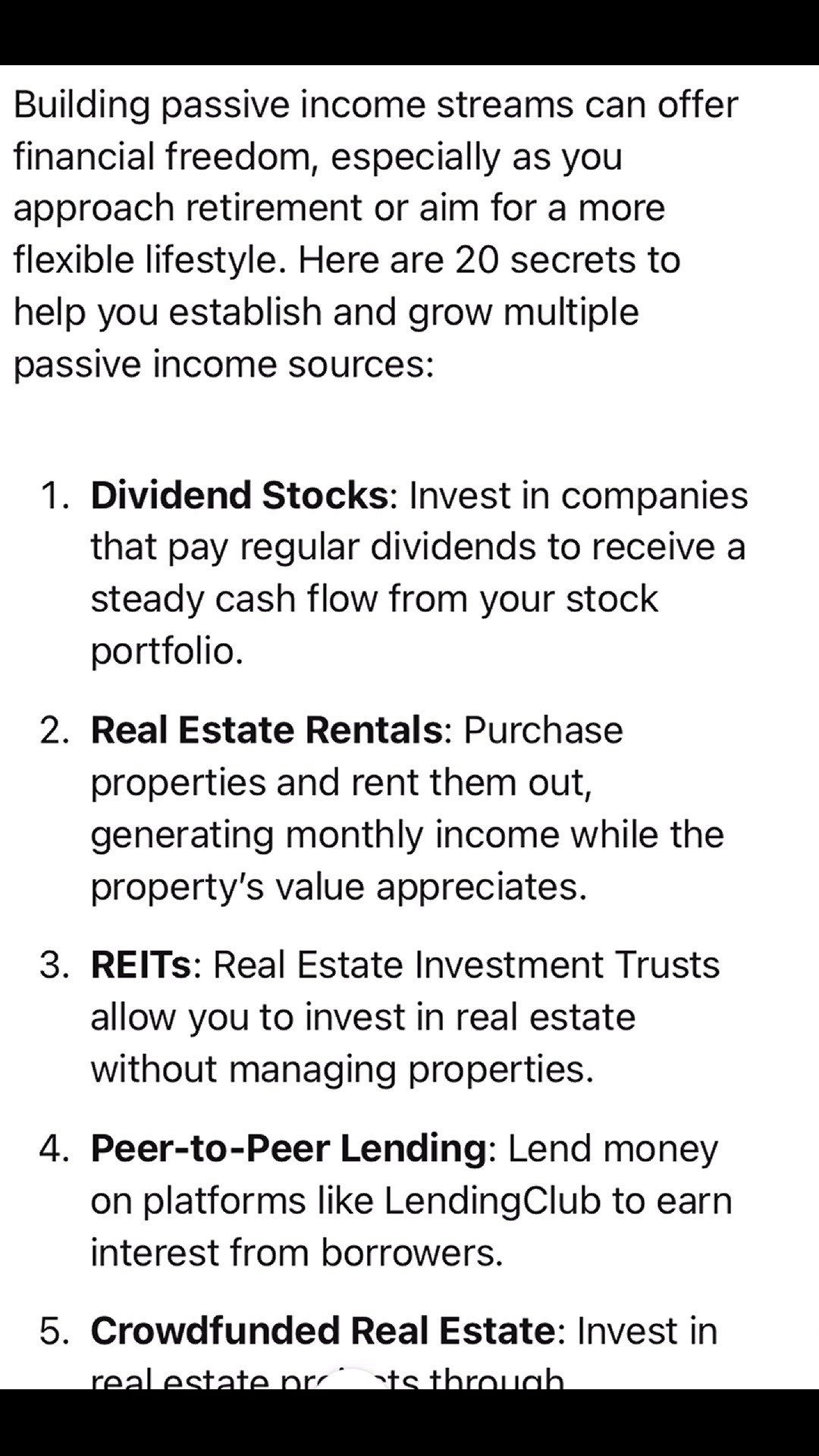

20 Passive Income Secrets

0 views · Oct 23, 2024 physicscalculations.com

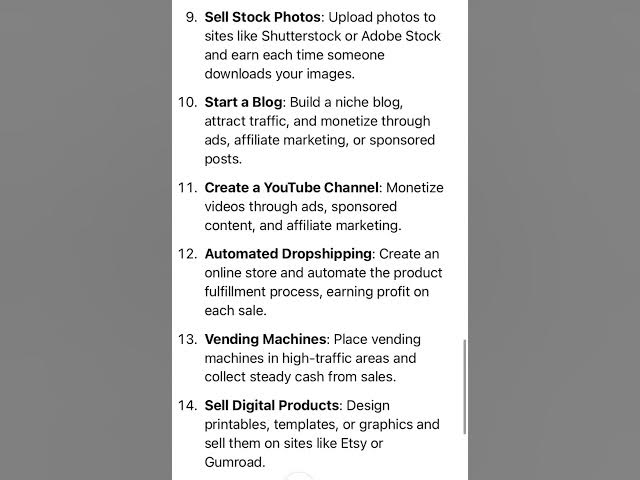

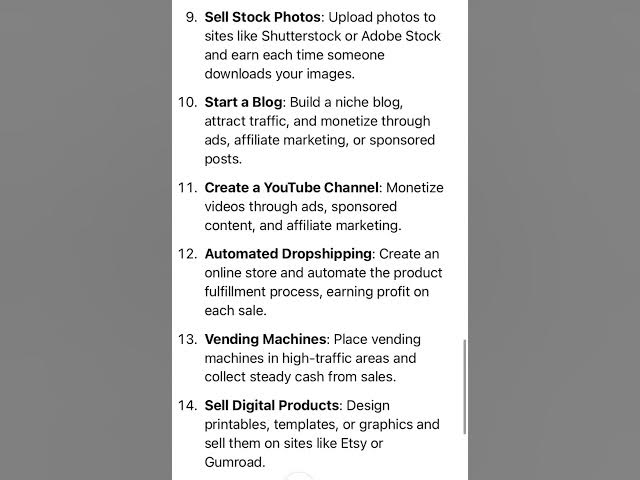

Building passive income streams can offer financial freedom, especially as you approach retirement or aim for a more flexible lifestyle. Here are 20 secrets to help you establish and grow multiple passive income sources: 1. Dividend Stocks: Invest in companies that pay regular dividends to receive a steady cash flow from your stock portfolio. 2. Real Estate Rentals: Purchase properties and rent them out, generating monthly income while the property’s value appreciates. 3. REITs: Real Estate Investment Trusts allow you to invest in real estate without managing properties. 4. Peer-to-Peer Lending: Lend money on platforms like LendingClub to earn interest from borrowers. 5. Crowdfunded Real Estate: Invest in real estate projects through crowdfunding platforms with lower upfront capital. 6. Create an Online Course: Share your expertise by creating a course on platforms like Udemy or Teachable and earn from every enrollment. 7. Write an eBook: Self-publish eBooks on Amazon Kindle or other platforms, receiving royalties from sales. 8. Affiliate Marketing: Promote products online and earn commissions when someone purchases through your referral links. 9. Sell Stock Photos: Upload photos to sites like Shutterstock or Adobe Stock and earn each time someone downloads your images. 10. Start a Blog: Build a niche blog, attract traffic, and monetize through ads, affiliate marketing, or sponsored posts. 11. Create a YouTube Channel: Monetize videos through ads, sponsored content, and affiliate marketing. 12. Automated Dropshipping: Create an online store and automate the product fulfillment process, earning profit on each sale. 13. Vending Machines: Place vending machines in high-traffic areas and collect steady cash from sales. 14. Sell Digital Products: Design printables, templates, or graphics and sell them on sites like Etsy or Gumroad. 15. License Music: If you’re musically inclined, create tracks and license them to earn royalties from various media outlets. 16. Build an App: Develop a mobile app that offers in-app purchases or subscription models to generate ongoing revenue. 17. Invest in Bonds: Bonds offer lower risk than stocks and provide interest payments over time. 18. Create a Membership Site: Offer exclusive content or resources through a subscription-based website. 19. Automated Forex Trading: Use algorithms to trade currency pairs and earn passive income with minimal effort. 20. Write a Patent or Trademark: Invent something new, patent it, and earn licensing fees from companies that want to use your creation. By diversifying across several passive income strategies, you can create a stable flow of earnings with minimal hands-on work.

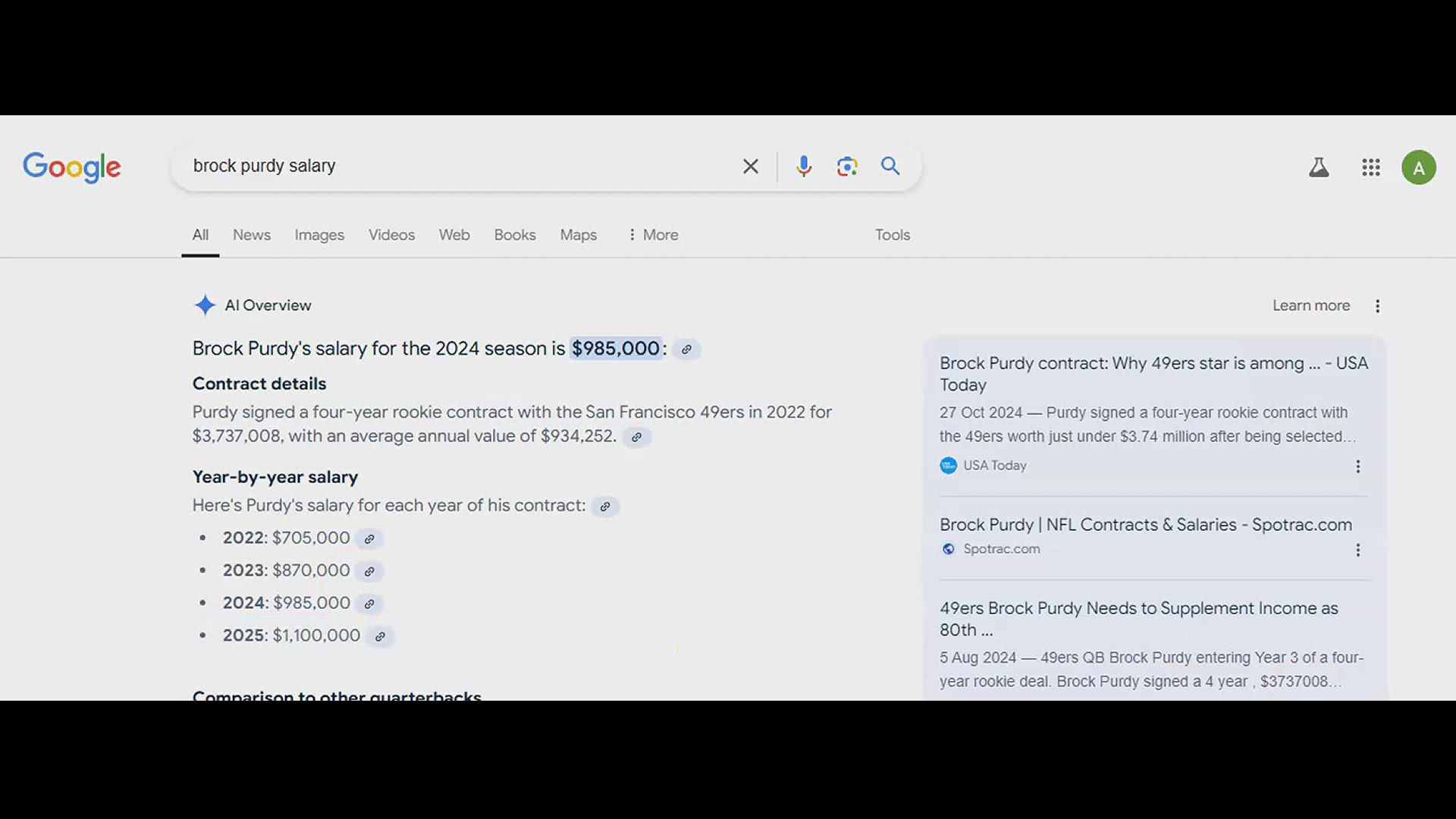

Brock Purdy Salary

39 views · Dec 6, 2024 physicscalculations.com

This video is a detailed analysis on Brock Purdy Salary

Passive Income Can Generate Wealth For You In Retirement

1 views · Jan 28, 2025 physicscalculations.com

Passive income can play a pivotal role in generating wealth for retirement, offering a reliable financial cushion without the need for active labor. Unlike earned income from a job, passive income requires an initial investment of time, money, or both but continues to generate returns over time with minimal ongoing effort. One popular method for creating passive income is through investments in dividend-paying stocks or bonds. These financial instruments provide regular payouts without the need to sell the underlying assets. Over time, with compounding interest, your wealth can grow significantly. Real estate is another avenue where rental properties can generate a steady stream of income, offering both immediate returns and potential appreciation in property value. Real estate investment trusts (REITs) provide a way to invest in real estate without the responsibility of managing properties. Another method is creating digital products or content. For instance, investing in websites, writing eBooks, or creating online courses allows you to receive income long after the initial creation phase. Affiliate marketing is also a powerful tool in the digital space, enabling you to earn commissions from promoting products or services. During retirement, passive income helps maintain financial stability, reducing the risk of outliving your savings. This diversified income stream offers more flexibility, allowing you to enjoy your retirement while minimizing reliance on traditional pension systems or social security. Furthermore, with the right mix of investments, passive income can keep up with inflation, preserving your purchasing power. By strategically building passive income streams before retirement, you create a financial foundation that offers independence and the freedom to enjoy retirement without constant financial worries.

Passive Income Can Generate Wealth For You In Retirement

1 views · Jan 28, 2025 physicscalculations.com

Passive income can play a pivotal role in generating wealth for retirement, offering a reliable financial cushion without the need for active labor. Unlike earned income from a job, passive income requires an initial investment of time, money, or both but continues to generate returns over time with minimal ongoing effort. One popular method for creating passive income is through investments in dividend-paying stocks or bonds. These financial instruments provide regular payouts without the need to sell the underlying assets. Over time, with compounding interest, your wealth can grow significantly. Real estate is another avenue where rental properties can generate a steady stream of income, offering both immediate returns and potential appreciation in property value. Real estate investment trusts (REITs) provide a way to invest in real estate without the responsibility of managing properties. Another method is creating digital products or content. For instance, investing in websites, writing eBooks, or creating online courses allows you to receive income long after the initial creation phase. Affiliate marketing is also a powerful tool in the digital space, enabling you to earn commissions from promoting products or services. During retirement, passive income helps maintain financial stability, reducing the risk of outliving your savings. This diversified income stream offers more flexibility, allowing you to enjoy your retirement while minimizing reliance on traditional pension systems or social security. Furthermore, with the right mix of investments, passive income can keep up with inflation, preserving your purchasing power. By strategically building passive income streams before retirement, you create a financial foundation that offers independence and the freedom to enjoy retirement without constant financial worries.

Passive Income Can Generate Wealth For You In Retirement

1 views · Jan 28, 2025 physicscalculations.com

Passive income can play a pivotal role in generating wealth for retirement, offering a reliable financial cushion without the need for active labor. Unlike earned income from a job, passive income requires an initial investment of time, money, or both but continues to generate returns over time with minimal ongoing effort. One popular method for creating passive income is through investments in dividend-paying stocks or bonds. These financial instruments provide regular payouts without the need to sell the underlying assets. Over time, with compounding interest, your wealth can grow significantly. Real estate is another avenue where rental properties can generate a steady stream of income, offering both immediate returns and potential appreciation in property value. Real estate investment trusts (REITs) provide a way to invest in real estate without the responsibility of managing properties. Another method is creating digital products or content. For instance, investing in websites, writing eBooks, or creating online courses allows you to receive income long after the initial creation phase. Affiliate marketing is also a powerful tool in the digital space, enabling you to earn commissions from promoting products or services. During retirement, passive income helps maintain financial stability, reducing the risk of outliving your savings. This diversified income stream offers more flexibility, allowing you to enjoy your retirement while minimizing reliance on traditional pension systems or social security. Furthermore, with the right mix of investments, passive income can keep up with inflation, preserving your purchasing power. By strategically building passive income streams before retirement, you create a financial foundation that offers independence and the freedom to enjoy retirement without constant financial worries.

20 Passive Income Secrets

0 views · Jan 28, 2025 physicscalculations.com

Building passive income streams can offer financial freedom, especially as you approach retirement or aim for a more flexible lifestyle. Here are 20 secrets to help you establish and grow multiple passive income sources: 1. Dividend Stocks: Invest in companies that pay regular dividends to receive a steady cash flow from your stock portfolio. 2. Real Estate Rentals: Purchase properties and rent them out, generating monthly income while the property’s value appreciates. 3. REITs: Real Estate Investment Trusts allow you to invest in real estate without managing properties. 4. Peer-to-Peer Lending: Lend money on platforms like LendingClub to earn interest from borrowers. 5. Crowdfunded Real Estate: Invest in real estate projects through crowdfunding platforms with lower upfront capital. 6. Create an Online Course: Share your expertise by creating a course on platforms like Udemy or Teachable and earn from every enrollment. 7. Write an eBook: Self-publish eBooks on Amazon Kindle or other platforms, receiving royalties from sales. 8. Affiliate Marketing: Promote products online and earn commissions when someone purchases through your referral links. 9. Sell Stock Photos: Upload photos to sites like Shutterstock or Adobe Stock and earn each time someone downloads your images. 10. Start a Blog: Build a niche blog, attract traffic, and monetize through ads, affiliate marketing, or sponsored posts. 11. Create a YouTube Channel: Monetize videos through ads, sponsored content, and affiliate marketing. 12. Automated Dropshipping: Create an online store and automate the product fulfillment process, earning profit on each sale. 13. Vending Machines: Place vending machines in high-traffic areas and collect steady cash from sales. 14. Sell Digital Products: Design printables, templates, or graphics and sell them on sites like Etsy or Gumroad. 15. License Music: If you’re musically inclined, create tracks and license them to earn royalties from various media outlets. 16. Build an App: Develop a mobile app that offers in-app purchases or subscription models to generate ongoing revenue. 17. Invest in Bonds: Bonds offer lower risk than stocks and provide interest payments over time. 18. Create a Membership Site: Offer exclusive content or resources through a subscription-based website. 19. Automated Forex Trading: Use algorithms to trade currency pairs and earn passive income with minimal effort. 20. Write a Patent or Trademark: Invent something new, patent it, and earn licensing fees from companies that want to use your creation. By diversifying across several passive income strategies, you can create a stable flow of earnings with minimal hands-on work.

20 Passive Income Secrets

0 views · Jan 28, 2025 physicscalculations.com

Building passive income streams can offer financial freedom, especially as you approach retirement or aim for a more flexible lifestyle. Here are 20 secrets to help you establish and grow multiple passive income sources: 1. Dividend Stocks: Invest in companies that pay regular dividends to receive a steady cash flow from your stock portfolio. 2. Real Estate Rentals: Purchase properties and rent them out, generating monthly income while the property’s value appreciates. 3. REITs: Real Estate Investment Trusts allow you to invest in real estate without managing properties. 4. Peer-to-Peer Lending: Lend money on platforms like LendingClub to earn interest from borrowers. 5. Crowdfunded Real Estate: Invest in real estate projects through crowdfunding platforms with lower upfront capital. 6. Create an Online Course: Share your expertise by creating a course on platforms like Udemy or Teachable and earn from every enrollment. 7. Write an eBook: Self-publish eBooks on Amazon Kindle or other platforms, receiving royalties from sales. 8. Affiliate Marketing: Promote products online and earn commissions when someone purchases through your referral links. 9. Sell Stock Photos: Upload photos to sites like Shutterstock or Adobe Stock and earn each time someone downloads your images. 10. Start a Blog: Build a niche blog, attract traffic, and monetize through ads, affiliate marketing, or sponsored posts. 11. Create a YouTube Channel: Monetize videos through ads, sponsored content, and affiliate marketing. 12. Automated Dropshipping: Create an online store and automate the product fulfillment process, earning profit on each sale. 13. Vending Machines: Place vending machines in high-traffic areas and collect steady cash from sales. 14. Sell Digital Products: Design printables, templates, or graphics and sell them on sites like Etsy or Gumroad. 15. License Music: If you’re musically inclined, create tracks and license them to earn royalties from various media outlets. 16. Build an App: Develop a mobile app that offers in-app purchases or subscription models to generate ongoing revenue. 17. Invest in Bonds: Bonds offer lower risk than stocks and provide interest payments over time. 18. Create a Membership Site: Offer exclusive content or resources through a subscription-based website. 19. Automated Forex Trading: Use algorithms to trade currency pairs and earn passive income with minimal effort. 20. Write a Patent or Trademark: Invent something new, patent it, and earn licensing fees from companies that want to use your creation. By diversifying across several passive income strategies, you can create a stable flow of earnings with minimal hands-on work.

10 Lessons that will take you from zero dollars to millions

19 views · Jan 28, 2025 physicscalculations.com

10 Lessons that will take you from zero dollars to millions

10 Lessons that will take you from zero dollars to millions

19 views · Jan 28, 2025 physicscalculations.com

10 Lessons that will take you from zero dollars to millions